|

| | Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? |  |

| | |

| Author | Message |

|---|

Guest

Guest

|  Subject: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 9:50 am Tue Sep 30, 2008 9:50 am | |

| tags: "May have Shored up Share Price" Anglo Irish Bank Nationalised The Government, early this morning, moved to guarantee all deposits and loans in every major Irish bank for a two year period. According to the Irish Times the guarantee was introduced on the advise of the Governor of the Central Bank. - RTE News wrote:

- The banks that are covered are: Allied Irish Bank, Bank of Ireland,

Anglo Irish Bank, Irish Life and Permanent, Irish Nationwide Building

Society and the Educational Building Society and specific subsidiaries

that may be approved by Government following consultation with the

Central Bank and the Financial Regulator.

Recently the Government guaranteed deposits of up to €100,000. now

it has gone further to cover all major deposits by financial

institutions with Irish banks. RTE News(Wording of the Bill as Enacted:cf) http://www.oireachtas.ie/documents/bills28/bills/2008/4508/b45a08d.pdf

Last edited by Auditor #9 on Mon Mar 09, 2009 10:49 am; edited 19 times in total (Reason for editing : Bring up to Date and Generalise in case ...) |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 9:54 am Tue Sep 30, 2008 9:54 am | |

| Could we see a surge in deposits with Irish banks? Couldn't that be good for our banks? I see the London Times already recommended that British people open Irish bank accounts following the €100,000 guarantee which was introduced last week. The Times. |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 10:09 am Tue Sep 30, 2008 10:09 am | |

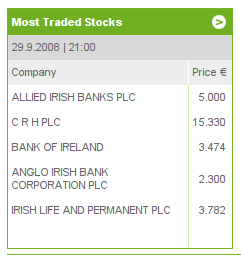

| That might change the values of the below for the better today so? The banks here could be sound enough then if the UK is advising that ... they want desperately to try to prevent banks runs though ... this could be a confidence trick, perhaps not. Someone on the property pin just said that if a bank goes now then the country foots the bill and it could come to billions. They also said, quoting David McWilliams, that the irish banking system has 500 billion behind it .. The Pin |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 10:14 am Tue Sep 30, 2008 10:14 am | |

| I hope it works, but it sounds like fairy dust: youngdan will have a thing or two to say about it. What they have done is nationalise the risk, without taking control. Do they know how much they have covered? Have all the banks given them an honest assessment of what's on their books? We are struggling to deal with an 8 billion deficit. Where would we get the money to deal with many times that amount as big defaults come in? We can't even print money like the US and Zimbabwe. Seems like they are betting on this all being over in a year. Good luck out there, to anyone worried about job, business, home or next meal. We can all meet up in the Sibin and cheer ourselves up with a virtual drink.  |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 10:21 am Tue Sep 30, 2008 10:21 am | |

| Have they said anything about the credit unions !? There is a piece of land behind my house that I've now got an eye on for planting. If a man had the petrol and wanted to head for the hills around here then the running water is often dangerous. Maybe there's some good enough stuff in the Burren.

Could it be time to stock up on petrol and spam? |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 10:26 am Tue Sep 30, 2008 10:26 am | |

| Going off reports on the news reports on the radio this morning everything is covered (including bonds) in all the main banks Quote: The Government has decided to guarantee all deposits in Irish banks. The banks that are covered are: Allied Irish Bank, Bank of Ireland, Anglo Irish Bank, Irish Life and Permanent, Irish Nationwide Building Society and the Educational Building Society and specific subsidiaries that may be approved by Government following consultation with the Central Bank and the Financial Regulator. Quote: The statement from the Department of Finance says all deposits, bonds and debt will be covered by the State. http://www.rte.ie/news/2008/0930/economy.htmlA worthwhile exchange from the Pin this morning: DSE3Br wrote: What does this mean? (A Random Walk) (Under CAB Investigation) "Dear god, the biggest blank cheque in the history of finance - the taxpayer is now exposed for hundreds of billions. They have just socialised losses and I don't see any reference to the taxpayer being able to benefit from the profits. What is this going to do to Irish Government bonds? Irish banks can now borrow at essentially subordinated Irish government bond prices. The Dail should be recalled immediately to discuss this. As a taxpayer I want to know where my equity stake in the banks is. I am extremely uncomfortable with this, I'll wait for wiser heads than mine before I come to a conclusion." "It means two things .... 1) that the government has promised State money to proetect every/any bank in the country. Potentially they have promised a blank cheque against your tax euros, State pension, others Social welfare .... 2) depending on just how far the government will go to 'defend' any bank they may have just painted a great big bullseye on every bank here for speculators, as the government has thrown it's weight into the ring behind the banks. Think the UK fighting to stay in the ERM. Expect the markets to test this." Interesting times. (Blue Horseshoe) We don't know how many hundreds of billions Magic A**** has promised to stand over, or where they would come from. The idea that the ECB would back this seems bizarre. This is Paulson Plus, put through without a bill, discussion in the Dail, or for that matter even a discussion in the Dail bar. |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 10:28 am Tue Sep 30, 2008 10:28 am | |

| - Auditor #9 wrote:

- Have they said anything about the credit unions !? There is a piece of land behind my house that I've now got an eye on for planting. If a man had the petrol and wanted to head for the hills around here then the running water is often dangerous. Maybe there's some good enough stuff in the Burren.

Could it be time to stock up on petrol and spam? Hi Audi - yes - there is a run on Lidl and Aldi down this way: everyone is maxing their limit and buying tins of John West ***joke*** One could do worse though  |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 10:42 am Tue Sep 30, 2008 10:42 am | |

| - Quote :

- We don't know how many hundreds of billions Magic A**** has promised to stand over, or where they would come from. The idea that the ECB would back this seems bizarre. This is Paulson Plus, put through without a bill, discussion in the Dail, or for that matter even a discussion in the Dail bar.

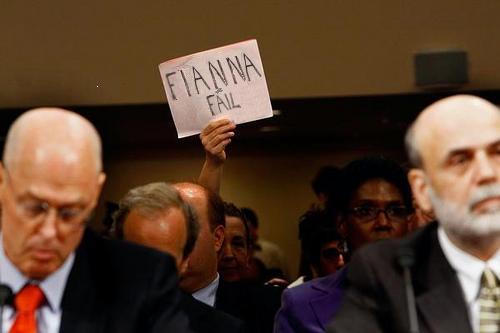

Morning cactus - got your popcorn? I was watching a programme on RTE yesterday about an english fella who built this passive home which could be heated for 60 pounds a year. Now that's a house. If you had a farm too with some animals, a windmill, a clean water supply and a couple of shotguns for yourself, the wife/hubby and the kids then that might equate to real wealth within the next few weeks. If a bank goes bust now am I to expect losing my dole to prop up the fella next door with the Jeep? Mother of Jesus. They'll put us working in the fields like slaves. I wouldn't mind that if I had the choice but as you say, no one was consulted and the exercised executive, nearly Martial power. I'd say the old tale about the government backing the banks in times of a run were all fine in theory in the good times and they never saw this coming. As youngdan says they haven't a pot to piss in. Nikkei down nearly 500 points, Dow down 777 points - the whole fecking thing will dry up soon enough and we'll be getting issued with butter vouchers out of the ATMs. Hard to believe it's all Fianna Fáils fault  Man, how the feck did we get so up ourselves? |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 10:53 am Tue Sep 30, 2008 10:53 am | |

| Just posted this off topic in the Canada thread.

youngdan wrote:

"If you want to know how it worked go back to 1912"

"I went back, and it went straight on to 1914-1918.

When a bubble bursts like this, there is a sore temptation on men with bombs to try and wipe a good portion of it out for a nice clean slate. There is a thread here on the US military plans for resource wars. Just so you and anyone else is sure, I am NOT in favour of this.

I understand that 80% of people in the US who don't want bail out are against the other 20% who do. This is a big divide. Left and right are on the same side in Congress against the robbers - the right will disappear from that side of the argument quickly enough once the election is over. I think that poor and middle class people who back robber barons need to think about it again. The "big money" layer of people are a parasitic form of existence who take out without putting in. They should go and get real jobs. The idea that moving money around should be rewarded by the power to suck everyone dry is imo crazy.

The Swedes got it more or less right when they had their banking collapse - the took the banks over as they went down, sorted them out and put them back into action when they were up and running again. Nobody running a bank was bailed out, but the economy was.

Our problem in doing that in Ireland is - is there the wherewithal to withstand the losses? A bankrupt bank is one thing and a bankrupt State is quite another.

In that event, the only way of keeping things like State services going is for the people running them to take them over and keep them going and try to find investment from outside.

If people think it can't happen they should look at Russia after the IMF went in - people in State services weren't paid for months on end."

I've a big day of work ahead of me, so will miss an interesting one. |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 11:19 am Tue Sep 30, 2008 11:19 am | |

| Was this necessary to do though? Was there plenty of bank-run noises around yesterday and over the past few days? Just because the share price is going skew-ways doesn't necessarily mean the bank isn't sound ...

Someone on the Pin just presented this scenario: a Big Bad Foreign Bank takes over one of the locals here now and has two years of availing of and abusing of guarantees on deposits and confidence that we can add the bank to our national debt ... I'd imagine in that case the regulator will be doing his job fairly smartly at that point and legislation would be tightened up around the BBFB among others ...

cheerio cactus you're leaving as the ship is sinking are you? I'm a rat myself I know how it feels. |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 11:28 am Tue Sep 30, 2008 11:28 am | |

| - Auditor #9 wrote:

- Hard to believe it's all Fianna Fáils fault

Man, how the feck did we get so up ourselves? It's only FF's fault in that they didn't stop us - and, heck, we wouldn't have voted them in again if they had. Nobody made us act like we were the Beveley Hillbillies. |

|   | | Ex

Fourth Master: Growth

Number of posts : 4226

Registration date : 2008-03-11

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 11:37 am Tue Sep 30, 2008 11:37 am | |

| - ibis wrote:

- Auditor #9 wrote:

- Hard to believe it's all Fianna Fáils fault

Man, how the feck did we get so up ourselves?

It's only FF's fault in that they didn't stop us - and, heck, we wouldn't have voted them in again if they had. Nobody made us act like we were the Beveley Hillbillies. I don't know. If they had introduced tighter controls on lending, say 3-4 years ago, to maintain a reasonable level of integrity on loan books, we may be much better off now, with not much impact back then ? On the other hand, we would be in deeper poo if we didn't have nine rate rises since december 2005. I think. | |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 11:50 am Tue Sep 30, 2008 11:50 am | |

| - EvotingMachine0197 wrote:

- I don't know. If they had introduced tighter controls on lending, say 3-4 years ago, to maintain a reasonable level of integrity on loan books, we may be much better off now, with not much impact back then ?

I agree. Guaranteeing deposits and loans in the Banks does not necessarily make them more attractive for the ordinary person to invest in, but may attract takeover and I wonder could it be open to abuse? By the way I think there should be a charge for the insurance. Announcing some measures to improve the clarity of the balance sheets and leverage ratios would go a long way to eventually restoring confidence. Would I be tempted to buy a share in AIB or whoever because of this? NO not a chance. Along comes some Spanish lot and I am wiped out. |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 12:10 pm Tue Sep 30, 2008 12:10 pm | |

| - Squire wrote:

- EvotingMachine0197 wrote:

- I don't know. If they had introduced tighter controls on lending, say 3-4 years ago, to maintain a reasonable level of integrity on loan books, we may be much better off now, with not much impact back then ?

I agree.

Guaranteeing deposits and loans in the Banks does not necessarily make them more attractive for the ordinary person to invest in, but may attract takeover and I wonder could it be open to abuse? By the way I think there should be a charge for the insurance.

Announcing some measures to improve the clarity of the balance sheets and leverage ratios would go a long way to eventually restoring confidence.

Would I be tempted to buy a share in AIB or whoever because of this? NO not a chance. Along comes some Spanish lot and I am wiped out. Sadly, I think that even the last two-three years may be found to have been where huge damage has been done. Land prices doubled last year. The fear from all is that if the true picture was known, there would be immediate meltdown. Does anyone think the Government has a clue what the implications are of a blank cheque for the banks? |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 12:21 pm Tue Sep 30, 2008 12:21 pm | |

| - Quote :

- Sadly, I think that even the last two-three years may be found to have been where huge damage has been done. Land prices doubled last year.

The fear from all is that if the true picture was known, there would be immediate meltdown.

Does anyone think the Government has a clue what the implications are of a blank cheque for the banks? The biggest threat now has to be unemployment. Lots of people are up to their necks in overinflated mortgages which is great if you want that property and can afford it. If you can't afford it then your job is insecure... If you can't afford it can you sell it? Negative equity now ... Could the like of this be the same for builders and those who have bought some land? As mairteenpak on p.ie this morning said "There will be plenty of state land to build social housing" |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 12:23 pm Tue Sep 30, 2008 12:23 pm | |

| I'm unsure on our bankruptcy laws. I heard on Radio 4 that people in America are declaring bankruptcy to avoid paying off mortgages which are over virtually worthless property. They do so because they can come out of the bankrupt position in a few years anyway and they get the debt off their backs. It puts them in a better position in the longrun.

Not sure what the situation is here because as far as I am aware we still lock people up when they don't pay their debts. Draconian. Criminal remedy for a Civil wrong goes against all notions within the law. |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 12:33 pm Tue Sep 30, 2008 12:33 pm | |

| - johnfás wrote:

- I'm unsure on our bankruptcy laws. I heard on Radio 4 that people in America are declaring bankruptcy to avoid paying off mortgages which are over virtually worthless property. They do so because they can come out of the bankrupt position in a few years anyway and they get the debt off their backs. It puts them in a better position in the longrun.

Not sure what the situation is here because as far as I am aware we still lock people up when they don't pay their debts. Draconian. Criminal remedy for a Civil wrong goes against all notions within the law. I believe that's the case here - the bank takes your house, sells it for whatever they can get and you pay the difference. Could be a whopping number. Who's putting pressure on the banks to do everything so quick? Can't a central bank, in the event of this turmoil, slow everything down and let people have a breathing space for a short period until the damage can be assessed or something. Banks going under like this doesn't happen every day. That's very centralised though. Would a liberalised system like in the states be any better? There's no denying we should have tried to stop ourselves getting here in the first place. The Pin site has been running for years - the opposing sentiment was there in some shape or form. |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 12:34 pm Tue Sep 30, 2008 12:34 pm | |

| - johnfás wrote:

- I'm unsure on our bankruptcy laws. I heard on Radio 4 that people in America are declaring bankruptcy to avoid paying off mortgages which are over virtually worthless property. They do so because they can come out of the bankrupt position in a few years anyway and they get the debt off their backs. It puts them in a better position in the longrun.

Not sure what the situation is here because as far as I am aware we still lock people up when they don't pay their debts. Draconian. Criminal remedy for a Civil wrong goes against all notions within the law. In the US people can walk away from their mortgages and properties. Here, if you stop paying, the house goes back to the bank which sells it cheap and you are then left to pay off the difference. This is Finfacts report on the bank deal - anyone got any more details? http://www.finfacts.ie/irishfinancenews/article_1014849.shtml |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 12:37 pm Tue Sep 30, 2008 12:37 pm | |

| - cactus flower wrote:

- Does anyone think the Government has a clue what the implications are of a blank cheque for the banks?

You really wonder at times. I don't have the time to look but surely there are conditions to this offer? There has to be a down side for the Bank and a potential to recoup loss out of whatever assets there are in the Bank? Sounds to me like a good time to use the advantages offered by the EU and move to another country. |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 12:46 pm Tue Sep 30, 2008 12:46 pm | |

| I am happy they have guaranteed the loans to banks despite my reservations. We are all in this together. Certainly I am dependent on credit flow to keep the business coming and I don't know of any civil servant who pays more tax than they earn so I guess they are in it with me. If the assets go down then the banks and shareholders (including my pension  ) will still get hit with losses. If the bank does eventually have to pony up to lenders then one would expect that there will be conditions set by the Government as to equity or nationalisation or otherwise. In the meantime the bank will pay for the guarantee. Obviously there is an exposure for the taxpayer but at least the bank will be getting a kick in the balls too which should mitigate against irresponsibility. My one concern is that the executives and should share in the pain as much as bank employees, taxpayers and the civil servants. Anyone know what is the cheapest quickest way for me to get some shares in a bank if I reckon they will survive all this? [EDIT - not giving advice or opinion on shares! I don't have a clue about that kind of stuff]

Last edited by Zhou_Enlai on Tue Sep 30, 2008 1:12 pm; edited 1 time in total |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 12:48 pm Tue Sep 30, 2008 12:48 pm | |

| Another proposal might be to make golden handshakes and severance payments for existing bank executives illegal. Past policies have proven to be foolhardy. It is time to do the job or lose the job. |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 12:49 pm Tue Sep 30, 2008 12:49 pm | |

| Ring a stockbroker. How about you spreadbet them though? You can do that in a few minutes on worldspreads or something. If you are confident they will go up just bet an amount that they will. Make sure you do it accurately and keep an eye on it though because I would imagine you can make large losses spread betting.

Advantage of spread betting over buying the shares of course is that the profits aren't liable to CGT. |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 1:03 pm Tue Sep 30, 2008 1:03 pm | |

| Timely maybe for us to remind ourselves that we do not and never would give advice here on investments.  |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 1:14 pm Tue Sep 30, 2008 1:14 pm | |

| Good point CF - post edited.

Johnfas, my one problem with spread betting is that you can lose more than you bet and the spread betting company then has to collect it. This may be dangerous if people can't pay up in which case the spread betting company may be would up (I think). Also, I don't know if spread betting compnies engage in a type of short selling by backing bets against real stocks. If so then it could be out-lawed. At least if you have the share certificates in your hand they are yours until the co goes belly up. |

|   | | Guest

Guest

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  Tue Sep 30, 2008 1:50 pm Tue Sep 30, 2008 1:50 pm | |

|

It’s interesting both here and on P.ie that those talking panic and generally not in favour of the Governments latest moves are from what might be described as left of the political spectrum.

No surprise really I suppose given that they distrust our economic system to start with, but more interesting still is the attitude of most FG posters who seem to have left aside party politics, gone with their core belief in the market, aren’t for panicking and have welcomed the governments efforts. Hats off to the Ladies & Gentlemen of the blue.

|

|   | | Sponsored content

|  Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? Subject: Re: Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks?  | |

| |

|   | | | | Nationalisation Watch / Govt. rethinking 3.5 billion bailout for the banks? |  |

|

Similar topics |  |

|

| | Permissions in this forum: | You cannot reply to topics in this forum

| |

| |

| |