|

| | The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** |  |

| | |

| Author | Message |

|---|

Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Mon Sep 15, 2008 11:42 pm Mon Sep 15, 2008 11:42 pm | |

| - MikeW wrote:

- Sorry cactus, I wasn't really trying to infer that you were a believer, but that list that starts with Rothschilds and goes downhill from there always annoys me.

I do agree with you however that there is a serious risk of a complete failure of the system. No problem at all MikeW - the thread is all the better for your post. I don't doubt that "complete failure" is a possibility, but find it very difficult to envisage. Is there any example you would think of of an economy that has achieved greater stability ? |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 12:01 am Tue Sep 16, 2008 12:01 am | |

| Shocking day at the markets today. Thousands of people are losing their jobs right now. Like it or not, private sector action and the free market are incapable of solving this.

15/09/2008 - 21:10:28

Wall Street stocks plunged today, with the Dow Jones industrials sliding 500 points, or 4.4%, in their worst point drop since the September 2001 terrorist attacks. Investors reacted badly to a shake-up of the financial industry following the meltdown of Lehman Brothers Holdings and Merrill Lynch.

Stocks also posted big losses in markets across much of the globe as investors absorbed Lehman’s bankruptcy filing and what was essentially a forced sale of Merrill Lynch to Bank of America for 50 billion dollars in stock. While those companies’ situations had reached some resolution, the market remained anxious about American International Group (AIG), which is seeking emergency funding to shore up its balance sheet. A faltering of the world’s largest insurance company likely would have financial implications far beyond that of Lehman, the largest US bankruptcy.

The swift developments that took place yesterday are the biggest yet in the 14-month-old credit crises that stems from now toxic sub-prime mortgage debt. Investors are worried that trouble at AIG and the bankruptcy filing by Lehman, felled by 60 billion dollars in bad debt and a dearth of investor confidence, will touch off another series of troubles for banks and financial institutions that may be forced to further writedown the value of their own debt assets.

Wall Street had been hopeful six months ago that the collapse of Bear Stearns would mark the darkest day of the credit crisis. AIG’s troubles a week after its stock dropped 45% are worrisome for some investors because of the company’s enormous balance sheet and the risks that troubles with that companies finances could spill over to the companies with which it does business. AIG, one of the 30 stocks that make up the Dow industrials, fell 6.93 dollars, or 57%, to 5.21 dollars today as investors worried that it would be the subject of downgrades from credit ratings agencies.

While the market was down sharply for much of the session, the selling accelerated in the last hour. According to preliminary calculations, the Dow fell 504.48, or 4.42%, to 10,917.51 moving below the 11,000 mark for the first time since mid-July. Broader stock indicators also fell. The Standard & Poor’s 500 index declined 58.74, or 4.69%, to 1,192.96, and the Nasdaq composite index fell 81.36, or 3.60%, to 2,179.91.

The S&P 500 broke through the 1,200.44 trading low seen in mid-July, a key level traders watch. Much of the trading day until about the last hour had been orderly because the market had tested another key level early in the session and managed to stay above it. But the eventual drift lower prompted some investors to hit the “sell” button. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 12:12 am Tue Sep 16, 2008 12:12 am | |

| - rockyracoon wrote:

- The Fed Reserve's independence and control is a grey area and may intentionally been enacted to be so. However, President Woodrow Wilson, who decried his own involvement in pushing for the arrangement, may serve as warning that the arrangement is not serving the best interests of the US population. The recent moves by successive Fed chairmen to install the now famous "puts" to banks while at the same time stoking inflation through historical money supply growth may also serve as a warning that the interests of the Fed and the interests of the US as a whole are in conflict. The Fed, simply stated, have played the game in the interests of their banking buddies while creating exponetial loan growth taken on by consumers, industry and indeed the Federal government itself. The entire US system is now in hock to the financiers and so are their children and grandchildren.

One doesn't have to be a conspiracy theorist to see what detrimental affects Fed Res policy has had on the US economy and the poltical well-being over the last 70 odd years. Rocky, these are all good points, and are as applicable to ECB as to the Fed. I'm not entirely sure that the interests of the Fed and the interests of the US were considered to be in conflict at the time though. It may have proved that it wasn't in the interests of the US economy, but ultimately it hasn't been in the interest of Lehmans or Bear either. However my over-riding issue with this is the same as my issue with the growing nonsense surrounding 9-11. There are a lot of lessons to learned from all of this and a lot of fundamental rethinks of the way the banks operate to be done without mixing in the rubbish produced by the likes of Kah Mullins and Paul. Lets try to fix the system that exists, not the system the Illuminati people think exists. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 12:28 am Tue Sep 16, 2008 12:28 am | |

| There is nothing wrong with the list that starts with Rothschild as he is the biggest owner. When the Fed was set up in 1913 the shareholders were the owners, simple as that. They were Morgan, Barings, Warburg, The NY Bank owned by Rockefellow etc. This idea that the Fed is owned by small banks is for the brain-dead. Most banks were forced to join into the system during the depression as the Eastern bankers did not want independent banks. As you said yourself it is compulsory and even if they are given shares they have no voting rights or anything and even if they had the amount of shares they own are miniscule. The origonal owners held all ownership to themselves. Those average Joe Smo banks own nada like you say, they are window dressing.

More window dressing is the 20 billion profit. Of course they can give it to the Treasury because Congress has allowed them to printup what could be 3000 billion to bail out Fannie.

You seem to suffer from the same ailment Ibis has. You never ask yourself who gets the 500 billion. Do you too think it just floats away.

Who do you thinks gets the money created to bail out the Fannie situation.

Who gets their paws on the money is basic to the whole scam so if you can not see who it is then you are lost.

Everyone knows who appoints the Chairman but he is chosen from a list of people given to him and is always an insider. The fact is the Fed is not part of the government and Bernanki does not take orders from Bush or Congress. For example the ceo of Morgan sits on the NY Fed board and the Treasury Secretary was the ceo of

Goldman as indeed Rubin was. These guys run the show

The best example of the purpose of the Fed was the Latin American Bailout. Who got the billions then was more easily seen and who got the shaft was obvious too. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 12:41 am Tue Sep 16, 2008 12:41 am | |

| - MikeW wrote:

- . . .However my over-riding issue with this is the same as my issue with the growing nonsense surrounding 9-11. There are a lot of lessons to learned from all of this and a lot of fundamental rethinks of the way the banks operate to be done without mixing in the rubbish produced by the likes of Kah Mullins and Paul. Lets try to fix the system that exists, not the system the Illuminati people think exists.

Agree with you on the ludicruous linkage with 9/11, etc. It's merely distracting from the real issues. However, there is always the possibility of jettisoning the existing system altogether and creating a new one which is not dependent on creating inflation; allocating capital resources based on short term expectations; and lastly is not worth manipulating for the priviledge of the few over the needs of the many. Some day the excesses of the present banking system will become apparent to the average joe and the game will be up. If we understand the basic facts about banking, all the malarky about CDOs, MBS, SIVs, Swaps, etc. becomes irrelevant. People with excess cash lend to people who need cash. It's really that simple. When you lend money you want to know you'll have a good chance of getting it back with some premium for those loans that are not paid in full. The lending institutions of the US and to some extent those in Europe threw all common sense out the window and lent to people who weren't in a position to pay back the money. Again very simple. However, the shennigans of the Fed along with the complicity of the US govt and the feeder banks (normal mortgage/personall lending banks and acilliaries) through the creation of a huge increase in the money supply to be lent in non-productive or minimal-productive enterprises underscores to need for a huge over-haul of financial structures and a return to traditional banking regulation at the very least. The problem is that many, if not most Western governments, are loathe to tell their populations that the hey-day of ever increasing economic growth has passed. The surplus days are over and sustainable, low level growth are the best we can achieve for the time being. Instead we've fallen for the ploy of selling over-priced assets to each other until such time as their are not enough schills to play the pyramid game and those who bought at the peak start defaulting on loans. The tulip bubble is as relevant today with the creation of our over supplied property market as it was to the Dutch experience in the 17th century. Different asset, different time, same result. That banks stoke these bubbles, and are allowed to by govt regulators, is probably the most distressing aspect; as is the fact that the average punter has learned nothing about tulip bubbles over the intervening centuries.    |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 1:05 am Tue Sep 16, 2008 1:05 am | |

| - rockyracoon wrote:

- MikeW wrote:

- . . .However my over-riding issue with this is the same as my issue with the growing nonsense surrounding 9-11. There are a lot of lessons to learned from all of this and a lot of fundamental rethinks of the way the banks operate to be done without mixing in the rubbish produced by the likes of Kah Mullins and Paul. Lets try to fix the system that exists, not the system the Illuminati people think exists.

Agree with you on the ludicruous linkage with 9/11, etc. It's merely distracting from the real issues. However, there is always the possibility of jettisoning the existing system altogether and creating a new one which is not dependent on creating inflation; allocating capital resources based on short term expectations; and lastly is not worth manipulating for the priviledge of the few over the needs of the many. Some day the excesses of the present banking system will become apparent to the average joe and the game will be up.

If we understand the basic facts about banking, all the malarky about CDOs, MBS, SIVs, Swaps, etc. becomes irrelevant. People with excess cash lend to people who need cash. It's really that simple. When you lend money you want to know you'll have a good chance of getting it back with some premium for those loans that are not paid in full. The lending institutions of the US and to some extent those in Europe threw all common sense out the window and lent to people who weren't in a position to pay back the money. Again very simple.

However, the shennigans of the Fed along with the complicity of the US govt and the feeder banks (normal mortgage/personall lending banks and acilliaries) through the creation of a huge increase in the money supply to be lent in non-productive or minimal-productive enterprises underscores to need for a huge over-haul of financial structures and a return to traditional banking regulation at the very least. The problem is that many, if not most Western governments, are loathe to tell their populations that the hey-day of ever increasing economic growth has passed. The surplus days are over and sustainable, low level growth are the best we can achieve for the time being.

Instead we've fallen for the ploy of selling over-priced assets to each other until such time as their are not enough schills to play the pyramid game and those who bought at the peak start defaulting on loans. The tulip bubble is as relevant today with the creation of our over supplied property market as it was to the Dutch experience in the 17th century. Different asset, different time, same result. That banks stoke these bubbles, and are allowed to by govt regulators, is probably the most distressing aspect; as is the fact that the average punter has learned nothing about tulip bubbles over the intervening centuries.    My question is did this artificial bubble happen because of a slip up in the morality stakes, or were there fundamental reasons why sound business was replaced by pie in the sky ? The Islamic banks are said to be doing well, and have a theoretically zero interest system - in practice as far as I understand when they advance money for a project they take some form of a share in it. Perhaps that makes them examine the viability of the arrangement more carefully. Also, I've read here that some workers co-operatives in Spain proved more able to deal with recessions and slumps than conventional firms. It seems to me that if the financial crash puts masses of people out of work, this should not be accepted, and that wherever possible people should take over the workplace and continue working/production. But making this work with no credit and a shrinking market is easier said than done. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 11:37 am Tue Sep 16, 2008 11:37 am | |

| - cactus flower wrote:

- My question is did this artificial bubble happen because of a slip up in the morality stakes, or were there fundamental reasons why sound business was replaced by pie in the sky ? The Islamic banks are said to be doing well, and have a theoretically zero interest system - in practice as far as I understand when they advance money for a project they take some form of a share in it. Perhaps that makes them examine the viability of the arrangement more carefully.

Also, I've read here that some workers co-operatives in Spain proved more able to deal with recessions and slumps than conventional firms.

It seems to me that if the financial crash puts masses of people out of work, this should not be accepted, and that wherever possible people should take over the workplace and continue working/production. But making this work with no credit and a shrinking market is easier said than done. Bubbles seem to take on a life of their own and are driven by primarily by the basest of human emotion, namely greed, allied with a large dose of stupidty. The external drivers may change from bubble to bubble but the dynamics (or internal workings) remain constant. Take Ireland, for example. Our housing bubble was made possible through but not exclusively by: 1. cheap money (ie cheap loans) 2. cultural belief that property is a safe have of wealth and only ever goes up in price. This belief is held despite concrete evidence that home prices over the past 100 years only marginally outperforms inflation. More often than not, you would have received surperior returns in alternative investments. 3. banks constant lowering of lending criteria to pump ever more money into the bubble 4. almost total relaxation of central banking regulatory examination of lending criteria 5. a government almost wholely dependent on construction revenues (taxes) for surplus spending projects and whose whole existence was predicated upon economic managerial expertise to win elections. Boiled down, you need a commodity, surplus cash sources and the ability to ignore historical risk/reward criteria. For a really good bubble, you need a central theme (unlimited growth potential with no down side risks) which requires a communication channel (the media outlets) and it helps vastly if the authorities at least ignore the bubbles creation and implementation or are ignorant of its ramifications. If the authorities actually become involved in sustaining the bubble, all the better. Those who remember that the risk/reward ratio will always revert back to a sustainable mean will win in the bubble game. The vast majority loose in the long run, and not just those who bought at the top of the bubble. It can take years or possibly longer for the corrosive effects of inflation, capital depletion and cost base dislocation to return to norms. Some people never recover. I would consider anything less than a 20% reduction in property prices to be considered a soft landing. However, this will leave us with some of the highest property prices relative to economic growth potential in the world. In any case, for those who can afford a mortgage and for those who will never be able to afford mortgages at high property price levels their standards of living will decline. Money borrowed today detracts from savings and the ability to invest. Contrary to popular belief, paying rent is not "dead money". It achieves the same things as paying a mortage, which afterall is nothing but 30 or 4o years of renting the property off the bank but with the added bonus of owning the property at the end of the mortgage period. If renters choose to rent because they can get a higher rate of return on excess capital than would accrue to the mortgage holder's final property value upon receipt of the deed, then renters would be better off in the long run. However, Imo many future renters will fall into the weekly wage/debt spiral in the coming years and won't have the excess capital to invest. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 12:28 pm Tue Sep 16, 2008 12:28 pm | |

|  Flirting with 4000. I agree with all your reasons for the housing price bubble in Ireland rockyracoon. There were also "real" market factors driving it. A baby boom generation came of age and Ireland had the highest natural population increase in the EU. There was a backlog of unmet housing need from the 1980s and early 1990s. The Government had virtually stopped building Social Housing that had previously met more than 25% of housing need There was a rapid growth of well paid employment that allowed people to get and pay mortgages and women entered the job market in much larger numbers. Housing supply was limited because of a severe shortage of zoned land with sanitary services. Limited land supply meant that land prices went through the roof. Prices were driven up as the whole cost of new infrastructure was charged by local councils as development contributions on developments: this was passed on to the buyers. Building prices went up even more than they would have, as useless development like holiday homes in scenic areas were encouraged by tax incentives and the NDP drew construction firms into road building and other types of development. The building industry went into top gear and by about 2006 supply began to meet demand and prices flattened. The single three measures in Irish hands that would imo have made the most difference would have been adequate servicing of lands from the mid 1990s when the shortage started, building more social housing in the early 2000s and not allowing more than 90% mortgages. Dealing with all the other issues we've mentioned would have helped too. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 4:20 pm Tue Sep 16, 2008 4:20 pm | |

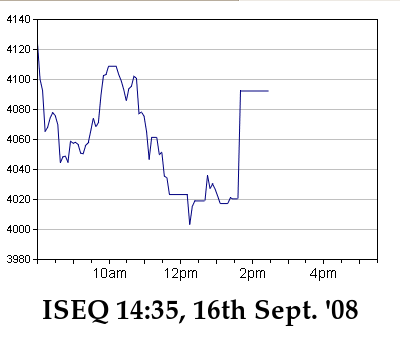

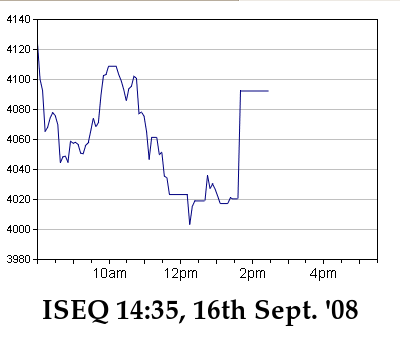

| |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 4:34 pm Tue Sep 16, 2008 4:34 pm | |

| - floatingingalway wrote:

- ISEQ has broken through the 4000 barrier. It's now at 3964

Something weird is happening the ISEQ - maybe this is the final bottoming-out now and the walking stick has come out to help it off the ground or maybe it's a computer glitch again or something.  |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 4:38 pm Tue Sep 16, 2008 4:38 pm | |

| - Auditor #9 wrote:

- floatingingalway wrote:

- ISEQ has broken through the 4000 barrier. It's now at 3964

Something weird is happening the ISEQ - maybe this is the final bottoming-out now and the walking stick has come out to help it off the ground or maybe it's a computer glitch again or something.

Intervention of some kind? A good lunch? or, as you say, a broken computer? |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 4:40 pm Tue Sep 16, 2008 4:40 pm | |

| - cactus flower wrote:

- ISEQ latest:

http://www.ise.ie/app/popup_graph.asp?INDEX_TYPE=

It looks like people had a good lunch. Strangely enough there seems to be a recent pattern of recovery around lunch time. Also some seem to have decided to jump in, or intervene when, it looks like going through 4000. This has happened on a number of occasions in the last few weeks. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 7:11 pm Tue Sep 16, 2008 7:11 pm | |

|  Whoever was supporting it ran out of money. Or else the computer was fixed. (sorry, but how do you get the ISEQ graphs up here ?) |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 7:23 pm Tue Sep 16, 2008 7:23 pm | |

| - cactus flower wrote:

Whoever was supporting it ran out of money. Or else the computer was fixed.

(sorry, but how do you get the ISEQ graphs up here ?) When you paste your print screen into paint, use the little broken-lined box to cut out the small piece. You must then save it as a .jpg or .png. Bitmaps can't be hosted here but a .jpg or .png file will upload here. I found that out since the last time you were trying to host something. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 8:54 pm Tue Sep 16, 2008 8:54 pm | |

| - cactus flower wrote:

- A baby boom generation came of age and Ireland had the highest natural population increase in the EU.

There was a backlog of unmet housing need from the 1980s and early 1990s.

The Government had virtually stopped building Social Housing that had previously met more than 25% of housing need

There was a rapid growth of well paid employment that allowed people to get and pay mortgages and women entered the job market in much larger numbers.

Housing supply was limited because of a severe shortage of zoned land with sanitary services. Limited land supply meant that land prices went through the roof.

Prices were driven up as the whole cost of new infrastructure was charged by local councils as development contributions on developments: this was passed on to the buyers. . .

Good points. You need an a priori start for any bubble, and as you point out, it usually begins from the best of economic motives. Even the tulip bubble of Holland was based originally on sound market principles as flowers have been a mainstay of the Dutch economy for centuries. However, there is a time period where ordinary economic economic activity turns into bubble activity. My guess is that if we broke the Irish growth rate over 5 year period for a fifteen year time span that was in the second five year period that the wheels started to come off real economic growth and the bubble began. If I remember correctly it was about this time that many people began to "fudge" the information on their mortgage applications. There's a good book or at least a good thesis to be written about the Irish property bubble. John Stumpf, CEO of Wells Fargo (US Bank): "It is interesting that the industry has invented new ways to lose money when the old ways seemed to work just fine."

Last edited by rockyracoon on Wed Sep 17, 2008 1:06 am; edited 1 time in total |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 9:46 pm Tue Sep 16, 2008 9:46 pm | |

| I think low interest rates had a lot to do with the wheels coming off. They exerted a double whammy.

On the one hand they made young people feel it was safe to take out a big mortgage.

On the other hand, they squeezed banks legitimate profits: there was pressure on to increase the volume of loans to compensate for the lower interest rates: commission encouraged bank staff to push loans like drug dealers and they accepted property as collateral for the loan.

Add on a commission system and the lack of regulation and it went off like a rocket. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 10:03 pm Tue Sep 16, 2008 10:03 pm | |

| The oil price is falling rapidly towards 80 which I predicted here on this site a good few months ago. It seems I've been vindicated by the events. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 10:33 pm Tue Sep 16, 2008 10:33 pm | |

| - Ard-Taoiseach wrote:

- The oil price is falling rapidly towards 80 which I predicted here on this site a good few months ago. It seems I've been vindicated by the events.

Every time the pump price drops, I think of you, Ard-Taoiseach.  |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 10:45 pm Tue Sep 16, 2008 10:45 pm | |

| With the oil call you have been correct. The deflation and slow down causing the fall works against your optimistic forecasts for stocks and the economy though. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Sep 16, 2008 11:12 pm Tue Sep 16, 2008 11:12 pm | |

| |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Wed Sep 17, 2008 12:26 am Wed Sep 17, 2008 12:26 am | |

| Funny oil should be mentioned. As meteoric as its rise had been, just as precipitous has been its fall. There are number of ways you can look this developement. I've just had a look at the Baltic Dry Index (BDI) which is a proxy for shipping demand of dry goods like iron ores, cerals, etc. The index has fallen from c 11,500 in April 2008 to c 4,800 today. I have to say I was somewhat shocked. Apparently China's demand, or rather lack of it, for iron ore has had the most profound affect on the index recently. I view the fall in oil below $100 pb, and certainly if it falls below $80 pb, as a sign that end users are expecting a curtailment in real consumption. This could presage a recessionary period for big oil consumption nations like the US. We'll have to wait and see.

While a lower price pb of oil is nice in the short term, if you believe that peak oil has been reached, a too cheap price may only serve to delay the investment and implementation of alternative fuel sources. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Wed Sep 17, 2008 12:42 am Wed Sep 17, 2008 12:42 am | |

| I'd see anything below 80 dollars as a shame, as that was said to be about the viability level for renewables. It seems to me likely that oil prices will tend to find that level, in the same way as wood chip prices have found the level of oil. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Wed Sep 17, 2008 5:43 am Wed Sep 17, 2008 5:43 am | |

| - rockyracoon wrote:

While a lower price pb of oil is nice in the short term, if you believe that peak oil has been reached, a too cheap price may only serve to delay the investment and implementation of alternative fuel sources. We need to keep fixed on the need for medium term energy self sufficiency. It is more than just an economic consideration. IMO it should be a priority. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Wed Sep 17, 2008 11:34 am Wed Sep 17, 2008 11:34 am | |

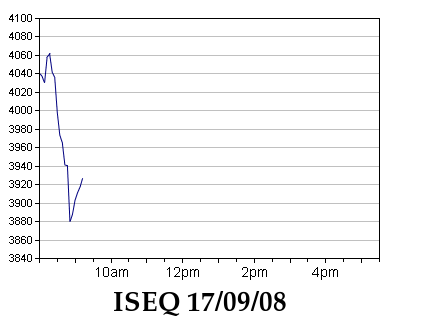

| - Squire wrote:

- rockyracoon wrote:

While a lower price pb of oil is nice in the short term, if you believe that peak oil has been reached, a too cheap price may only serve to delay the investment and implementation of alternative fuel sources.

We need to keep fixed on the need for medium term energy self sufficiency. It is more than just an economic consideration. IMO it should be a priority. Is there the fear that the low oil price will remove the stimulus for developing renewables? The ISEQ looks like this this morning  |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Wed Sep 17, 2008 12:39 pm Wed Sep 17, 2008 12:39 pm | |

| Is this market not at 1000 yet. |

|   | | Sponsored content

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  | |

| |

|   | | | | The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** |  |

|

Similar topics |  |

|

| | Permissions in this forum: | You cannot reply to topics in this forum

| |

| |

| |

Hitskin.com

Hitskin.com