|

| | The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** |  |

| | |

| Author | Message |

|---|

Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Sat Jun 21, 2008 11:06 am Sat Jun 21, 2008 11:06 am | |

| If that happens people will be talking about the Celtic Vortex. Bit rich blaming the EU on a decade of home grown mismanagement.

Bad time of the year to expect a rally odds are against that over the holiday months. There is a lot of truth in 'sell in May and go away'.

As for the Banking sector, I wouldn't be in any hurry to jump in there, but perhaps that is due to an utter contempt for banks. They treat their normal customers like excrement and search the earth looking for bad debt to buy. This happens over and over about every 8-10 years by my reckoning. Unfortunately they are a necessity, but we are poorly served. Who in their right mind would lend over 100% on any property and on earnings multiples that only a serious addiction to cocaine could explain? I would let the dust settle a bit more before jumping in to that sector. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Sat Jun 21, 2008 8:08 pm Sat Jun 21, 2008 8:08 pm | |

| Bubbles happen all the time. The South Sea Bubble and tulipmania were the most extreme. The property bubble in Ireland is easily understood. When the ECB took over the rates went from about 7 to 3% so now the same monthly payment could service a much larger mortage. Simple as that The price of the decision to give away monetary control will now be paid. The lies told to disguise this obvious truth will be priceless. The voters deserve it because they believed what they wanted to believe. Did not Ahern just recently give money to Africa. Nobody stands up and says Hey that is my money and I need it, give away your own. Everyone wants something from the government. Whether it's a tooth filled or a free house. A country of leechs and the biggest leech of all is Cowen with his pay being the highest in the Universe. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Sun Jun 22, 2008 12:16 am Sun Jun 22, 2008 12:16 am | |

| Yes mortgages became cheaper but that is no excuse for the government to simply sit back and say, "Oh it was interest rates, sorry nothing we could do". Could have increased stamp duty etc. Also no excuse for the local banks to drag people off the streets and give 100% loans on houses with cash back inducements, indeed any house, or to decide crazy lending criteria.

Must confess to not being terribly fond of some aspects of government spending, but there are areas of life that I would prefer were public. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Sun Jun 22, 2008 4:18 am Sun Jun 22, 2008 4:18 am | |

| That is why we sometimes have to compromise. This government is even more inept that most. The banks need to fail for their stupidity. This stamp duty is a joke. Are people so stupid that they pay 40000 euro tax on a house without a whimper. Now the government are screwed because if they eliminate it they should reinburse everyone that was stuck with it. The craic is on now as the taxpayers are tapped out. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Sun Jun 22, 2008 11:55 am Sun Jun 22, 2008 11:55 am | |

|  - cyberianpan wrote:

-

- Quote :

ISEQ in crash territory!

If the Irish economy is so rosy

Don't conflate the Irish Economy & the ISEQ. Considering say employers: how many are wholly foreign now ? E.g. Google, Microsoft, Intel alone make up ~10,000 employees. Most services workers belong to the global economy. Yup the Irish Banks & Cement Companies are tanking but they don't make the whole picture of Irish economy . Also have you analysed which specific companies fell - did Food fall by much etc.

This is bad... for some.

cYp http://www.politics.ie/viewtopic.php?p=765833#p765833At the beginning of the Iseq thread on p.ie last year when the index was around 10,000 points. Where did the money go? Who lost the money since ? The building industry has caved in now - The new irish minister for funny money, Brian Lenihan said so much during the week (a two-post analysis in thePin http://www.thepropertypin.com/viewtopic.php?t=10996 ) And some Irish banks have "71% of loans secured against commercial property and residential mortgages" http://www.thepropertypin.com/viewtopic.php?t=10621More disagreement from thePin with the Sunday Indo suggestion that builders should be bailed out and to re-ignite the property bubble here (because it was such a good money spinner for everyone... http://www.thepropertypin.com/viewtopic.php?t=10996 (same as first above) I think it was builders who made a lot of money out of this, where is their money now ? Maybe they invested it in tech stocks or alternative energy companies or the like - something which ordinary people will be investing in in the future through consumption in an attempt to make their lives more affordable ... ? No, the builders kept on building in Spain and Florida and invested their money in trophies like SUVs, one-off style McMansions with seven bathrooms* outside (not in, oh no) Carrigaholt and the good life... A lasting contribution to the Irish economy .. *  |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Sun Jun 22, 2008 1:15 pm Sun Jun 22, 2008 1:15 pm | |

| Money is either dissipated on frivolity or it moves to where there is a clear opportunity to make a profit. No one in their right mind would hold money in Irish property since say 2006 and by inference in any sectors indirectly involved, ie banking and construction generally.

Some money has moved abroad to growing economies where there is a real need for housing, offices, hotels and warehouses. In a way there are also more taking positions that assume a long term fall in the value of the Euro against other currencies.

Quite seriously why would anyone invest in property in Ireland right now or risk banking. Later in the year we may get a clearer picture. If property drops fast there may be some pickings, but a more likely scenario is 20% fall followed by 3 years stasis. What good is that for any investor unless you are planning a project that is say 10 years out? |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Sun Jun 22, 2008 1:20 pm Sun Jun 22, 2008 1:20 pm | |

| On stamp duty it would be better to wait to the end of the year to abolish it. Allow for a bit of a drop now, then cut in time for the spring sales. If you do that the property market will bottom out in the winter. If you drop in the holidays or going into winter the effect will be dissipated. Hold fire until you see the whites of their eyes. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Mon Jun 23, 2008 3:08 pm Mon Jun 23, 2008 3:08 pm | |

| - Squire wrote:

- Money is either dissipated on frivolity or it moves to where there is a clear opportunity to make a profit. No one in their right mind would hold money in Irish property since say 2006 and by inference in any sectors indirectly involved, ie banking and construction generally.

Some money has moved abroad to growing economies where there is a real need for housing, offices, hotels and warehouses. In a way there are also more taking positions that assume a long term fall in the value of the Euro against other currencies.

Quite seriously why would anyone invest in property in Ireland right now or risk banking. Later in the year we may get a clearer picture. If property drops fast there may be some pickings, but a more likely scenario is 20% fall followed by 3 years stasis. What good is that for any investor unless you are planning a project that is say 10 years out? What seems to be happenening is that there are 20% drops in asking prices but valuers are putting a valuation of 20% less than asking price for mortgage purposes. The banks have massive amounts loaned out to builders and developers for land purchases made over the last two years. There are a lot of developers and builders who have bought land at top price for millions - the banks are trying to keep the deals afloat, and they will turn some over for non-housing development, but all these situations will not work themselves out well. In my view the banks are likely to incurr substantial losses in some instances.

Last edited by cactus flower on Mon Jun 23, 2008 4:20 pm; edited 1 time in total |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Mon Jun 23, 2008 4:06 pm Mon Jun 23, 2008 4:06 pm | |

| Thanks CF - that is a good thread on the property pin, primarily because of the way it links in a few Sunday Independent articles to show a pattern in their reporting.

Whatever about Brian Lenihan's comments the S.I.'s reporting of them seems desiged to propagate a crash. It is hard to know what they are at. I must give Mr. Kane and Mr. Wynand a shout to see if they can provide any insight. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Mon Jun 23, 2008 4:15 pm Mon Jun 23, 2008 4:15 pm | |

| - Auditor #9 wrote:

- cyberianpan wrote:

-

- Quote :

ISEQ in crash territory!

If the Irish economy is so rosy

Don't conflate the Irish Economy & the ISEQ. Considering say employers: how many are wholly foreign now ? E.g. Google, Microsoft, Intel alone make up ~10,000 employees. Most services workers belong to the global economy. Yup the Irish Banks & Cement Companies are tanking but they don't make the whole picture of Irish economy . Also have you analysed which specific companies fell - did Food fall by much etc.

This is bad... for some.

cYp http://www.politics.ie/viewtopic.php?p=765833#p765833

At the beginning of the Iseq thread on p.ie last year when the index was around 10,000 points. Where did the money go? Who lost the money since ? The building industry has caved in now - The new irish minister for funny money, Brian Lenihan said so much during the week

(a two-post analysis in thePin http://www.thepropertypin.com/viewtopic.php?t=10996 )

And some Irish banks have "71% of loans secured against commercial property and residential mortgages"

http://www.thepropertypin.com/viewtopic.php?t=10621

More disagreement from thePin with the Sunday Indo suggestion that builders should be bailed out and to re-ignite the property bubble here (because it was such a good money spinner for everyone...

http://www.thepropertypin.com/viewtopic.php?t=10996 (same as first above)

I think it was builders who made a lot of money out of this, where is their money now ? Maybe they invested it in tech stocks or alternative energy companies or the like - something which ordinary people will be investing in in the future through consumption in an attempt to make their lives more affordable ... ?

No, the builders kept on building in Spain and Florida and invested their money in trophies like SUVs, one-off style McMansions with seven bathrooms* outside (not in, oh no) Carrigaholt and the good life... A lasting contribution to the Irish economy ..

*  Sadly for some, as well as a bit on shiny SUVs they reinvested most of the money in buying land at top whack and are left with increasing interest payments and zero house sales. The sellers of land are the ones who have creamed it, as they have pocketed vast amounts without having invested any time or money. Capital gains tax for land sales is low. They are not evil people, it is just the system we have here. The public paid for infrastructure to service the land, and that is ultimately paid back by housebuyers as the house price includes development contributions to local authorities. This has pushed farm land prices up too, as farmers on the edge of towns and cities have bought replacement farms further away with their land sales profits. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Mon Jun 23, 2008 4:30 pm Mon Jun 23, 2008 4:30 pm | |

| - cactus flower wrote:

- Sadly for some, as well as a bit on shiny SUVs they reinvested most of the money in buying land at top whack and are left with increasing interest payments and zero house sales. The sellers of land are the ones who have creamed it, as they have pocketed vast amounts without having invested any time or money.

Capital gains tax for land sales is low.

They are not evil people, it is just the system we have here. The public paid for infrastructure to service the land, and that is ultimately paid back by housebuyers as the house price includes development contributions to local authorities.

This has pushed farm land prices up too, as farmers on the edge of towns and cities have bought replacement farms further away with their land sales profits. fromT.S. Eliot's Choruses from 'The Rock',1936: - Quote :

- And now you live dispersed on ribbon roads,

And no man knows or cares who is his neighbor

Unless his neighbor makes too much disturbance,

But all dash to and fro in motor cars,

Familiar with the roads and settled nowhere.

Much to cast down, much to build, much to restore

I have given you the power of choice, and you only alternate

Between futile speculation and unconsidered action.

And the wind shall say: "Here were decent godless people:

Their only monument the asphalt road

And a thousand lost golf balls." I'm not religious but that poem is true. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Mon Jun 23, 2008 4:55 pm Mon Jun 23, 2008 4:55 pm | |

| No one should have been able to borrow money to buy land at the price many were asking. It is the economics of the mad house. Also there is a matter of supply and demand and lack of strategic planning.

I made a few shillings in the North by predicting that they were going to tighten up on developments in the countryside. Lord Rooker obliged and I am still smiling.

Up there there is some bizarre planning policy playing its way through the system where 60% of all new housing is to be on Brown field sites in the Greater Belfast area. The sites either don't exist or are not for sale. They have to rezone land. This can't last, they are creating a housing shortage. The question is where and when will they rezone.

Even in a weak market major developments or changes in Government policy can reap good profits, if you keep your eyes open. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Mon Jun 23, 2008 6:17 pm Mon Jun 23, 2008 6:17 pm | |

| - Squire wrote:

- No one should have been able to borrow money to buy land at the price many were asking. It is the economics of the mad house. Also there is a matter of supply and demand and lack of strategic planning.

I made a few shillings in the North by predicting that they were going to tighten up on developments in the countryside. Lord Rooker obliged and I am still smiling.

Up there there is some bizarre planning policy playing its way through the system where 60% of all new housing is to be on Brown field sites in the Greater Belfast area. The sites either don't exist or are not for sale. They have to rezone land. This can't last, they are creating a housing shortage. The question is where and when will they rezone.

Even in a weak market major developments or changes in Government policy can reap good profits, if you keep your eyes open. There were supply and demand issues. There was very strong demand from the late 90s which was in part predictable on the basis of population projection. Government bet on continued emigration and lost. There was very little serviced land and very little zoned land, with an absurd "rationing" approach from the DoE and local planners and little understanding of land release - a lot of land is in family trusts for example and can't be sold overnight for development just because a planner has zoned it. When the problem was on the way to being solved in the early 2000s with increased supply and some government funding for servicing land, government cut social housing construction, leaving a lot of people without housing they could afford. At the same time they provided tax incentives for holiday homes and rural areas and accelerated road construction, which put more pressure on building costs. Banks have been involved in every property boom and bust that there ever was. They never learn. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Mon Jun 23, 2008 9:15 pm Mon Jun 23, 2008 9:15 pm | |

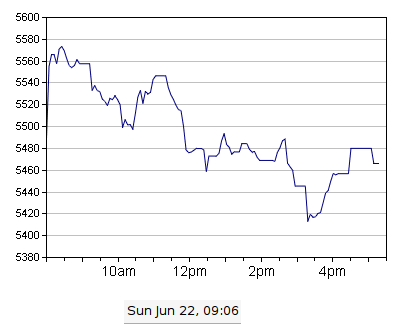

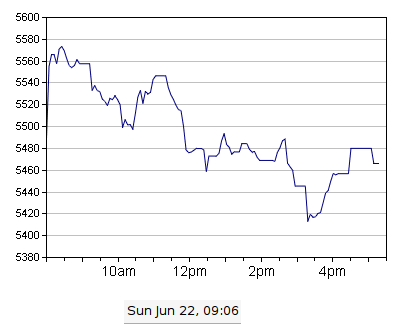

| The ISEQ took another major knock today with over 70 points lost. It is now at just under 5400. |

|   | | Ex

Fourth Master: Growth

Number of posts : 4226

Registration date : 2008-03-11

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Mon Jun 23, 2008 11:29 pm Mon Jun 23, 2008 11:29 pm | |

| Anyone got a link to good ISEQ history graphs. E.g 1 year/6 month etc. | |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Jun 24, 2008 12:08 am Tue Jun 24, 2008 12:08 am | |

| - EvotingMachine0197 wrote:

- Anyone got a link to good ISEQ history graphs. E.g 1 year/6 month etc.

Sure, not a very good one but LINK |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Jun 24, 2008 12:13 am Tue Jun 24, 2008 12:13 am | |

| - Auditor #9 wrote:

- EvotingMachine0197 wrote:

- Anyone got a link to good ISEQ history graphs. E.g 1 year/6 month etc.

Sure, not a very good one but

LINK Apart from Auditor's charming take on the descent of our ISEQ, the Irish Stock Exchange website www.ise.ie is very good. Just click "Share Prices & Indices" on the top of the page, "ISEQ® Equity Index Data" on the left of the page and then click the little G for "View Historic Graph". You can customise your graph from there. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Jun 24, 2008 2:03 am Tue Jun 24, 2008 2:03 am | |

| The RTE site, business section is what I use. Good enough for as I only watch these out of curiosity. Most give you charts looking back but I will search for ones that give the future 5 years |

|   | | Ex

Fourth Master: Growth

Number of posts : 4226

Registration date : 2008-03-11

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Jun 24, 2008 3:12 am Tue Jun 24, 2008 3:12 am | |

| - Auditor #9 wrote:

- EvotingMachine0197 wrote:

- Anyone got a link to good ISEQ history graphs. E.g 1 year/6 month etc.

Sure, not a very good one but

LINK What do you mean 'not a good one' I thought it was so good I've re-produced it here. (copyright permission pending)  | |

|   | | Guest

Guest

| |   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Jun 24, 2008 12:25 pm Tue Jun 24, 2008 12:25 pm | |

| Is that a graph of our pensions?

I suppose this is mainly the banks. In that case I would say they have a way to go down yet. |

|   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Jun 24, 2008 12:35 pm Tue Jun 24, 2008 12:35 pm | |

|  I have forty euros in a Laser card - is it going to be ok ? |

|   | | Guest

Guest

| |   | | Guest

Guest

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Jun 24, 2008 12:40 pm Tue Jun 24, 2008 12:40 pm | |

| It's heading towards 5260 now ... That's it, I'm off to BOI to empty that Laser and put it into my own biscuit tin .. |

|   | | Ex

Fourth Master: Growth

Number of posts : 4226

Registration date : 2008-03-11

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  Tue Jun 24, 2008 1:11 pm Tue Jun 24, 2008 1:11 pm | |

| - Auditor #9 wrote:

- It's heading towards 5260 now ... That's it, I'm off to BOI to empty that Laser and put it into my own biscuit tin ..

That biscuit tin could soon be more valuable than the contents. | |

|   | | Sponsored content

|  Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** Subject: Re: The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED**  | |

| |

|   | | | | The ISEQ Thread Part I - March 2008 - October 2008 **LOCKED** |  |

|

Similar topics |  |

|

| | Permissions in this forum: | You cannot reply to topics in this forum

| |

| |

| |

Hitskin.com

Hitskin.com