|

| | Foreign Exchange Watch |  |

| | |

| Author | Message |

|---|

Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Wed Jan 07, 2009 6:14 pm Wed Jan 07, 2009 6:14 pm | |

| Obama's tax stimulus package gave the dollar some strength, thus dragging the other "anglos" with it including sterling. Also the market is starting to price in a rate cut by the ECB on January 15th. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Wed Jan 07, 2009 6:16 pm Wed Jan 07, 2009 6:16 pm | |

| - Slim Buddha wrote:

- Obama's tax stimulus package gave the dollar some strength, thus dragging the other "anglos" with it including sterling. Also the market is starting to price in a rate cut by the ECB on January 15th.

Is there not likely to be a cut in the UK too? |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Wed Jan 07, 2009 7:30 pm Wed Jan 07, 2009 7:30 pm | |

| - cactus flower wrote:

- Slim Buddha wrote:

- Obama's tax stimulus package gave the dollar some strength, thus dragging the other "anglos" with it including sterling. Also the market is starting to price in a rate cut by the ECB on January 15th.

Is there not likely to be a cut in the UK too? Not much further the Sterling rate can go down. I am sure we will see "quantitive easing" before any more tampering with rates. The Euro is playing catch-up in this game. Rates must come down to keep the Germans happy. An economy like Germany's which relies so much on exports needs a competitive Euro. Youngdan and I have opposing views on the dollar. I believe it will appreciate whereas he believes it will go down significantly. I believe the Euro is in for a torrid time in the first 6 months of 09 and I would not be surprised if we see €/$ at somewhere between 1.1800 and 1.2300 sooner rather than later. €/£ I see at 0.8000 - 0.8300, possibly before the end of the month and possibly lower than that. Just my opinion, though.  |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 09, 2009 6:06 pm Fri Jan 09, 2009 6:06 pm | |

| - cactus flower wrote:

- Slim Buddha wrote:

- Obama's tax stimulus package gave the dollar some strength, thus dragging the other "anglos" with it including sterling. Also the market is starting to price in a rate cut by the ECB on January 15th.

Is there not likely to be a cut in the UK too? Well, cactus, there was a rate cut in the UK and, amazingly, they are now expected to go down further. Yet, when this logically would give the Euro an even greater premium, the €/£ went down and reached a new low of 0.8878 today. I am expecting this to go to 0.8500, possibly next week. The ECB meets on Thursday and I expect a 50 basis point rate reduction which to some extent is already being priced into the market. Anything above that will accelerate the descent of the Euro. The US employment report, which you alluded to on another thread, came in as expected and actually boosted the dollar against the Euro. $ now at 1.3515 v the €. It's Friday afternoon and I don't expect much more to happen though when the US is on its own this evening, we may see some action. It happens sometimes on the back of a big report but as tihs came in on the expectation, I would be surprised. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 16, 2009 12:12 pm Fri Jan 16, 2009 12:12 pm | |

| €/£ below 0.8900p. The ECB 50 basis point reduction produced mixed results on the forex market. €/£ was above 90p before the reduction was announced. Sterling is up a penny at 0.8893 now and the Euro gained a cent+ against the dollar and is now 1.3220. I think the £ is still a buy, as is the dollar after Obama's party next Tuesday. I see the dollar at below 1.25 and the £ at below 85p before the end of the month.

My belief is based on the following. Love him or loathe him, Gordon Brown has, from the beginning of this crisis, given clear signals as to how he sees a "solution" working out. We don't know yet if it will work but he has a defined plan. The market know where he wants to go and the forex market in particular likes some certainty. Obama has not yet gone into the detail of his plan but it is taking shape and I expect a flurry of announcements as soon as he gets his feet under the table. The Euro is a different animal. Who speaks for the Euro?

The coming year will make or break this currency. Constituent countries around the edges (Italy, Ireland, Greece, Spain and Portugal) will face huge challenges simply to stay in the currency and Germany and France will have too many domestic distractions to be in a position to shore them up. The uncertainty this will cause will put the Euro under pressure long-term (by which I mean Long-term in forex = 6-12 months.) Safe havens for forex traders will be Yen and CHF, but the economies of Japan and Switzerland have troubles of their own. Nothing compared to the potential nightmare facing the Euro , though.

Anybody else got a view? |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 16, 2009 12:28 pm Fri Jan 16, 2009 12:28 pm | |

| - Slim Buddha wrote:

The coming year will make or break this currency. Constituent countries around the edges (Italy, Ireland, Greece, Spain and Portugal) will face huge challenges simply to stay in the currency and Germany and France will have too many domestic distractions to be in a position to shore them up. The uncertainty this will cause will put the Euro under pressure long-term (by which I mean Long-term in forex = 6-12 months.) Safe havens for forex traders will be Yen and CHF, but the economies of Japan and Switzerland have troubles of their own. Nothing compared to the potential nightmare facing the Euro , though.

Anybody else got a view? Not sure about all of that analysis. According to Finfacts, the US and the UK are looking at nationalising/recapitalising yet more banks. It appears Mr Lenihan and Anglo are among friends. I'm actually amazed we held out this long. Also a link on MSN...they've listed the UK, the US and Ireland, on equal terms as maybe being worst affected by this recession (because of the property booms) http://money.uk.msn.com/investing/articles/morecommentary/article.aspx?cp-documentid=12770130 Anyway, Ireland is only one, small, Eurozone country. Yes Gordon may have a plan, but having lived there for ages, unlike here, the culture of spin permeates those who produce the stats, and I suspect things are much worse than reported. Our stats are dire, but I would suspect they are reported honestly. I can give examples if you like (the UK government hiding PFI debt, it's huge and it is not listed as national debt, the fact that UK road death stats double if you include people who die later in hospital, this one was admitted by the ONS (office of national statistics) who said they were "worried" about it...the fact that most people are on NHS waiting lists for years despite official waiting lists being less than 6 months)....Sooner or later all the spin and lies will come home to roost. Their ministers are off discussing more incipient banking meltdowns anyway The US.... well, we just won't go there. Huge amounts money needed by yet more banks. Obama due for the mother of all stress headaches, by next Tuesday night. The Eurozone... well, one in 7 German jobs are related to car manufacture. See the problem?? When even Toyota is posting a loss, PROBLEM. These guys shore the euro up. Their banking sector is beginning to produce a distinct aroma of dead rodent as well, Deutsche Bank has just lost 4bn odd in the last quarter of last year. The German Government has high debt levels already, although the German public do not. They've already bailed out Hypo and Commerzbank, while Sachsen LB went t!ts up at the beginning of this crisis My analysis: Ireland and the US had property markets that peaked before everyone elses. The others are behind us, but that is NOT to say they won't catch up. Where does this leave exchange rates?? well, they will fluctuate according to who is producing the worst news at any given time... take your bets now please. The "shock" though to the Euro may exceed the others once everyone realises how badly the german car industry is taking things. Not to mention their banks. There is a reason bank is a 4 letter word..... |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 16, 2009 12:45 pm Fri Jan 16, 2009 12:45 pm | |

| - expat girl wrote:

- Slim Buddha wrote:

The coming year will make or break this currency. Constituent countries around the edges (Italy, Ireland, Greece, Spain and Portugal) will face huge challenges simply to stay in the currency and Germany and France will have too many domestic distractions to be in a position to shore them up. The uncertainty this will cause will put the Euro under pressure long-term (by which I mean Long-term in forex = 6-12 months.) Safe havens for forex traders will be Yen and CHF, but the economies of Japan and Switzerland have troubles of their own. Nothing compared to the potential nightmare facing the Euro , though.

Anybody else got a view?

Not sure about all of that analysis. According to Finfacts, the US and the UK are looking at nationalising/recapitalising yet more banks. It appears Mr Lenihan and Anglo are among friends. I'm actually amazed we held out this long. Also a link on MSN...they've listed the UK, the US and Ireland, on equal terms as maybe being worst affected by this recession (because of the property booms)

http://money.uk.msn.com/investing/articles/morecommentary/article.aspx?cp-documentid=12770130

Anyway, Ireland is only one, small, Eurozone country. Yes Gordon may have a plan, but having lived there for ages, unlike here, the culture of spin permeates those who produce the stats, and I suspect things are much worse than reported. Our stats are dire, but I would suspect they are reported honestly. I can give examples if you like (the UK government hiding PFI debt, it's huge and it is not listed as national debt, the fact that UK road death stats double if you include people who die later in hospital, this one was admitted by the ONS (office of national statistics) who said they were "worried" about it...the fact that most people are on NHS waiting lists for years despite official waiting lists being less than 6 months)....Sooner or later all the spin and lies will come home to roost. Their ministers are off discussing more incipient banking meltdowns anyway

The US.... well, we just won't go there. Huge amounts money needed by yet more banks. Obama due for the mother of all stress headaches, by next Tuesday night.

The Eurozone... well, one in 7 German jobs are related to car manufacture. See the problem?? When even Toyota is posting a loss, PROBLEM. These guys shore the euro up. Their banking sector is beginning to produce a distinct aroma of dead rodent as well, Deutsche Bank has just lost 4bn odd in the last quarter of last year. The German Government has high debt levels already, although the German public do not. They've already bailed out Hypo and Commerzbank, while Sachsen LB went t!ts up at the beginning of this crisis

My analysis: Ireland and the US had property markets that peaked before everyone elses. The others are behind us, but that is NOT to say they won't catch up.

Where does this leave exchange rates?? well, they will fluctuate according to who is producing the worst news at any given time... take your bets now please. The "shock" though to the Euro may exceed the others once everyone realises how badly the german car industry is taking things. Not to mention their banks.

There is a reason bank is a 4 letter word..... I accept yout point about spin, expat girl, and the Brits seem to be addicted to this kind of bull, but a clear direction, however "wrong" it may be, is what Brown has given the markets. Property was a huge Achilles Heel in the economies of Ireland, the UK and the US. Yet we still refuse to eliminate this toxicity. Anglo has been nationalised instead of being put to the sword. While Ireland may be a small country in the Euro, Spain and Italy are not and Spain's property rubbish is, if anything, worse than ours. I agree that, when it boils down to it, the Euro is mainly about the German economy. Our fate is inextricably linked to that. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 16, 2009 3:08 pm Fri Jan 16, 2009 3:08 pm | |

| - Slim Buddha wrote:

While Ireland may be a small country in the Euro, Spain and Italy are not and Spain's property rubbish is, if anything, worse than ours. I agree that, when it boils down to it, the Euro is mainly about the German economy. Our fate is inextricably linked to that. We may be are banjaxed so. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 16, 2009 3:27 pm Fri Jan 16, 2009 3:27 pm | |

| - coc wrote:

- Slim Buddha wrote:

While Ireland may be a small country in the Euro, Spain and Italy are not and Spain's property rubbish is, if anything, worse than ours. I agree that, when it boils down to it, the Euro is mainly about the German economy. Our fate is inextricably linked to that. We may be are banjaxed so. THe Germans don't have anything near the same levels of personal debt. They don't like credit cards. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 16, 2009 3:37 pm Fri Jan 16, 2009 3:37 pm | |

| That won't matter if their manufacuting base collpases due to collapsing demand. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 16, 2009 3:45 pm Fri Jan 16, 2009 3:45 pm | |

| - coc wrote:

- Slim Buddha wrote:

While Ireland may be a small country in the Euro, Spain and Italy are not and Spain's property rubbish is, if anything, worse than ours. I agree that, when it boils down to it, the Euro is mainly about the German economy. Our fate is inextricably linked to that. We may be are banjaxed so. From that blog - he's talking our kinda language - Quote :

- The more sobre version would be this one from Paul Krugman that I keep using:

“There is a burgeoning economic crisis in the European periphery,” Krugman said on the ABC network Dec. 14. “The money has dried up. That’s the new center, the center of this crisis has moved from the U.S. housing market to the European periphery.”

Either way, the economic meltdown in parts of Europe’s Eastern and Southern periphery is now in the process of working its way back up the pipes and to the core, to Germany in terms of the collapse in GDP growth and exports, and to Austria in terms of stress on the banking system. They are calling the Portugal Italy Ireland Greece Spain countries 'PIIGS' by the way. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 16, 2009 3:56 pm Fri Jan 16, 2009 3:56 pm | |

| - Slim Buddha wrote:

THe Germans don't have anything near the same levels of personal debt. They don't like credit cards. You are right, and they have low mortgage levels and stable house prices also. On the downside; they have only just gotten back on their feet after paying for re-unification, they have a huge tax burden, 60% GDP (more by now) government debt... that'll rise as the banks and car manufacturers look for bailouts. There is a high level of tax avoidance/evasion and Switzerland and Austria (who do not share depositors information) just to the south. Their unemployment levels, again, have only been on the wane for the last 2-3 years. 1/7th jobs directly/indirectly linked to the car industry and Frankfurt ranks highly as a finance centre (not great news right now). Exports are down, folks, down. The banks are in trouble. Factories are being mothballed or put on part time work. It's the German Government debt I'm worried about, not the personal. Oh, and their banks. Along with everyone elses Trichet was quoted as saying that he didn't rule out using instruments other than interest rates The implication was that they'd be buying Government bonds....... Ahoy me hearties, welcome aboard the Good Ship Debt.... she's holed in the hold, so man the pumping stations...... |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 16, 2009 5:26 pm Fri Jan 16, 2009 5:26 pm | |

| - Slim Buddha wrote:

- €/£ below 0.8900p. The ECB 50 basis point reduction produced mixed results on the forex market. €/£ was above 90p before the reduction was announced. Sterling is up a penny at 0.8893 now and the Euro gained a cent+ against the dollar and is now 1.3220. I think the £ is still a buy, as is the dollar after Obama's party next Tuesday. I see the dollar at below 1.25 and the £ at below 85p before the end of the month.

My belief is based on the following. Love him or loathe him, Gordon Brown has, from the beginning of this crisis, given clear signals as to how he sees a "solution" working out. We don't know yet if it will work but he has a defined plan. The market know where he wants to go and the forex market in particular likes some certainty. Obama has not yet gone into the detail of his plan but it is taking shape and I expect a flurry of announcements as soon as he gets his feet under the table. The Euro is a different animal. Who speaks for the Euro?

The coming year will make or break this currency. Constituent countries around the edges (Italy, Ireland, Greece, Spain and Portugal) will face huge challenges simply to stay in the currency and Germany and France will have too many domestic distractions to be in a position to shore them up. The uncertainty this will cause will put the Euro under pressure long-term (by which I mean Long-term in forex = 6-12 months.) Safe havens for forex traders will be Yen and CHF, but the economies of Japan and Switzerland have troubles of their own. Nothing compared to the potential nightmare facing the Euro , though.

Anybody else got a view? No, but I've got a question. Is the UK's dependency on the banking/finance sector (did I hear 20% of the economy) a problem for it, or is there enough work to be done in banking trying to fix everything? |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 16, 2009 6:12 pm Fri Jan 16, 2009 6:12 pm | |

| Interesting question. I would say the former, because the obscene bonuses will be trickling to a halt, which will filter into the real economy soon enough. And there will be layoffs. It will be a while before we find out though, because I don't trust UK figures. Some of us will probably carry on thinking Gordon has some of the answers until and if there is some sort of sudden meltdown.

At least our lot are trying to think about doing something about the deficits. No sign of that happening across the H2O. Only the Tories are discussing it and they aint in power |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 16, 2009 6:16 pm Fri Jan 16, 2009 6:16 pm | |

| We have to think about deficits alot more because of our higher reliance on overseas goods. When Britain borrows a much higher percentage of their money stays in their economy. When we borrow we are borrowing to import so we borrow to give other economies money. Essentially Britain's borrowing is more likely to create jobs and domestic industry than ours. Jim Power was making a big deal of this on the radio the other day. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Wed Jan 21, 2009 10:54 pm Wed Jan 21, 2009 10:54 pm | |

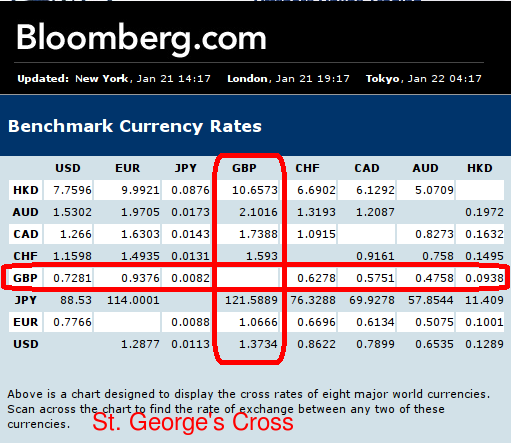

| So we're expecting the Punt Sterling to go BOOM soon then with all the printing that they will be doing ? I see an initial period of boom shopping where even people from New York fly into Newry to avail of the cheapo prices of everything. I'd go shopping there myself but I don't think it would be worth the trek from Clare unless Newry had the same climate as Zimbabwe. After the initial firesale I don't know what will happen... Inventory will have been cleaned out and paying to restock will be the issue I suppose. The Irish consumer economy should be further affected as SuperQuinn today have been through job losses of around 400. To restock there will have to be more money printed unless there is genuine continuous demand balanced by the exact quantity printed, but this might start to fail as the UK cheap domino falls on Border businesses here. The broke Border region will then fall back on Newry and the next phase will be Lidl and Aldi booming. After that is exhausted people will have to forage for nuts and berries. The Border region could become desolate and devoid of any real commerce, like West Clare, and perhaps people will leave the BMW region and flood back into cities here ? Maybe Dublin or Galway could experience another minor property boom as the devastation ripples out from Her Majesty's Secret Photocopying Machine ?  http://www.bloomberg.com/markets/currencies/fxc.html http://www.bloomberg.com/markets/currencies/fxc.html |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Wed Jan 21, 2009 11:12 pm Wed Jan 21, 2009 11:12 pm | |

| Border regions already are becoming desolate. Superquinn today announced they are shutting their supermarket in Dundalk because nobody shops in it. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Jan 23, 2009 12:56 am Fri Jan 23, 2009 12:56 am | |

| I am torn between thinking Doom is Nigh for the UK (and then by extension, ourselves) and then actually wondering if the German banks and car industry, the Dutch bank that is allegedly looking for 25bn yoyos (rumoured by one of the freesheets yesterday, dunno how accurate that is), us, the Spanish, Greeks, Portuguese and Italians will cause the Euro to out slump sterling

Paddy Power got any odds? |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Wed Feb 25, 2009 12:20 pm Wed Feb 25, 2009 12:20 pm | |

| It'll be interesting to see how the pound affects us if it keeps dropping. Hugh Hendry in the other video says that the Euro itself could be stabilised by border regions at the edge of the Eurozone. Is that what the EU officials below are concerned about ? We'll take advantage of northern fire-sales, further pressuring our own retail activity here thus affecting taxes, employment, maybe even industry and personnel... ? The last thing we need now. Feb. 25 (Bloomberg) -- European Union officials are concerned that the pound’s slide to a record low against the euro could destabilize the British economy, according to a document prepared last month by European Commission and EU finance ministry officials.

http://www.bloomberg.com/apps/news?pid=20601087&sid=a_YTLOsiNWMM&refer=home

The pound’s “very rapid” drop “raises questions about the financial stability of the British economy,” said the document, which was prepared ahead of the Feb. 14 Group of Seven meeting in Rome and obtained by Bloomberg News. The currency’s weakness “is a source of concern for the euro area.”

The report contradicts Prime Minister Gordon Brown’s argument on Feb. 13 that a weaker currency helps rather than hinders the economy. With the pound down 18 percent against the euro in the past year, it also underscores investors’ concern about Britain’s fiscal health as the government racks up debt to fund bank bailouts. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Thu Mar 05, 2009 11:47 am Thu Mar 05, 2009 11:47 am | |

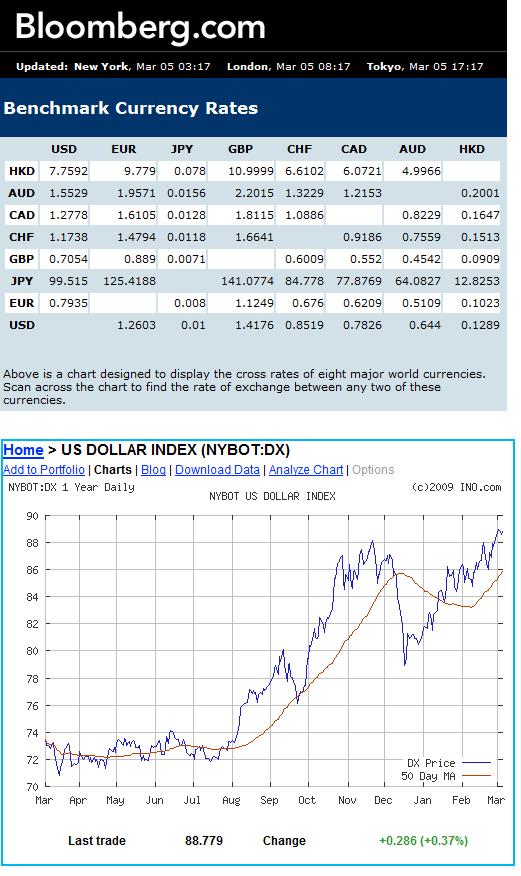

| - Quote :

- Europe’s banks face a $2 trillion dollar shortage

European banks face a US dollar “funding gap” of almost $2 trillion as a result of aggressive expansion around the world and may have difficulties rolling over debts, according to a report by the Bank for International Settlements.

http://www.telegraph.co.uk/finance/financetopics/recession/4939796/Europes-banks-face-a-2-trillion-dollar-shortage.html

European banks now owe 2trillion to debt denominated in dollars .... - Quote :

- The BIS said European and British banks have relied on an “unstable” source of funding, borrowing in their local currencies to finance “long positions in US dollars”. Much of this has to be rolled over in short-term debt markets.

...

The report, entitled “US dollar shortage in global banking”, helps explain why there has been such a frantic scramble for dollars each time the credit crisis takes a turn for the worse. Many investors have been wrong-footed by the powerful rally in the dollar against almost all currencies, except the yen.

...

The BIS said the total “funding gap” in dollars was around $2.2 trillion at the peak, when money market liabilities are included. This had fallen to around $2 trillion by the time of the Lehman Brothers collapse. The data is collected with a lag but it appears that there are still huge dollar liabilities to be covered.

Simon Derrick, currency chief at the Bank of New York Mellon, said the implications are obvious. “The global bullion of the last eight years was funded on dollar balance sheets, so the capital destruction we’re seeing leaves banks starved for dollars. Dollar is clearly going to appreciate a lot further,” he said.  http://www.bloomberg.com/markets/currencies/fxc.htmlhttp://quotes.ino.com/chart/?s=NYBOT_dx http://www.bloomberg.com/markets/currencies/fxc.htmlhttp://quotes.ino.com/chart/?s=NYBOT_dx |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Thu Mar 05, 2009 11:54 am Thu Mar 05, 2009 11:54 am | |

| Presumably a cut in interest rates should see the Euro decline slightly in value but perhaps that has already been factored in given that the economists seem to know of these cuts a number of days in advance.

Anyone who plays the currency market in terms of debt obligations is mad and in alot of ways has what is coming to them when it goes haywire. A charity I have had a minor involvement with in the past has run into a problem with the exchange rate, they held everything in sterling but half their staff are employed in the eurozone. Net result is a deficit of nearly 100,000 for a small charity. Absolute madness, would never have happened if johnfás was still on their organising committee. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Thu Mar 05, 2009 12:06 pm Thu Mar 05, 2009 12:06 pm | |

| What would you have done johnfás? It looks like there is plenty of money to be made on currency speculation if you have the knack, the money and the nerve. The swing between the Dollar and Euro in the last while has been a right little game altogether.

Currency strength might be based on the fundamentals of every economy but the American one. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Thu Mar 05, 2009 1:03 pm Thu Mar 05, 2009 1:03 pm | |

| I'm not a speculator, certainly not with money that isn't my own - prudence has to be the name of the game. If you are an organisation with a significant proportion of your paid staff in a particular jurisdiction you should be holding significant cash and other reserves in the denomination of that jurisdiction. It wasn't an easy thing to get home to people when sterling was so strong because if you ran a body that had interests both North and South you could live on the basis that the contributions from, and monies held in, the North would buy you far more in the South owing to the strength of Sterling. However, that is short term planning in the extreme.... and it is something which is coming back to bite this particular organisation now and unfortunately will result in a significant proportion of those employed by this particular organisation losing their jobs. |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Mar 06, 2009 8:02 pm Fri Mar 06, 2009 8:02 pm | |

| - johnfás wrote:

- Presumably a cut in interest rates should see the Euro decline slightly in value but perhaps that has already been factored in given that the economists seem to know of these cuts a number of days in advance.

Anyone who plays the currency market in terms of debt obligations is mad and in alot of ways has what is coming to them when it goes haywire. A charity I have had a minor involvement with in the past has run into a problem with the exchange rate, they held everything in sterling but half their staff are employed in the eurozone. Net result is a deficit of nearly 100,000 for a small charity. Absolute madness, would never have happened if johnfás was still on their organising committee. While the Euro rate cut was priced in, the big event this week was today with the publication of the US unemployment rate and related data. The Euro appreciated immediately after that was made public |

|   | | Guest

Guest

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  Fri Mar 06, 2009 8:32 pm Fri Mar 06, 2009 8:32 pm | |

| - Slim Buddha wrote:

- johnfás wrote:

- Presumably a cut in interest rates should see the Euro decline slightly in value but perhaps that has already been factored in given that the economists seem to know of these cuts a number of days in advance.

Anyone who plays the currency market in terms of debt obligations is mad and in alot of ways has what is coming to them when it goes haywire. A charity I have had a minor involvement with in the past has run into a problem with the exchange rate, they held everything in sterling but half their staff are employed in the eurozone. Net result is a deficit of nearly 100,000 for a small charity. Absolute madness, would never have happened if johnfás was still on their organising committee.

While the Euro rate cut was priced in, the big event this week was today with the publication of the US unemployment rate and related data. The Euro appreciated immediately after that was made public Is there any currency that is not going to be a basket case by summer? |

|   | | Sponsored content

|  Subject: Re: Foreign Exchange Watch Subject: Re: Foreign Exchange Watch  | |

| |

|   | | | | Foreign Exchange Watch |  |

|

Similar topics |  |

|

| | Permissions in this forum: | You cannot reply to topics in this forum

| |

| |

| |

Hitskin.com

Hitskin.com